Complete your new account application within 15 minutes through the Eurobank Mobile App, without coming to a branch.

Through the Eurobank Mobile App

Download the Eurobank Mobile App on your mobile for free:

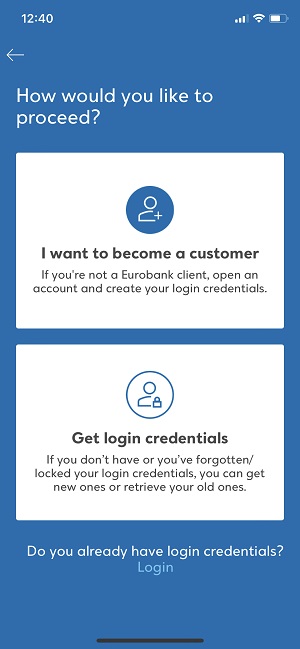

Open the app to sign up. Your screen displays your available options.

If you do not bank with Eurobank, to open an account for your day-to-day transactions:

Choose: I want to become a customer

You will need approximately 15 minutes to complete your application. You do not have to come to a branch.

To be able to monitor the progress of your application, you need to allow the app to send you notifications.

If you fail to do so at the time, you may turn them on later through your phone Settings.

Fill in your mobile number

The first step to opening an account is to fill in your mobile number.

To verify it, you enter the One-Time Passcode (OTP) you receive via SMS.

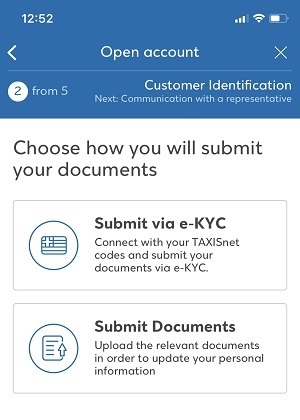

Submit your details

The next step is to choose how you want to submit your details. You may:

- Log in to eGov KYC.

- Upload files or photos of all your supporting documents.

If you choose the eGov KYC app:

- Enter your TAXISnet credentials to automatically update your details. We inform you once we have received your details.

- Confirm that all details appearing on the screen are correct. Your details are grouped in 4 categories (personal, contact, professional and income details).

- Take a photo of your face and ID card (front and back). If all the details we need are available through eGov KYC, you don’t have to submit any other supporting documents. If not, we ask you to upload files or photos of the supporting documents we need.

If you choose to upload files or photos of all your supporting documents, you proceed as follows:

- For proof of identity – take a headshot on the spot and a photo of a document proving your identity.

- For your income and profession – choose your professional status, i.e. salaried employee, self-employed, student, etc. and upload the supporting documents verifying your income and capacity.

- For your home address – we need to know your address to send you your debit card by post.

Once you submit all required documents, wait for 5 minutes for us to check them. If necessary, we may ask you to resubmit some of them.

Find out the supporting documents required for your application.

One of our representatives contacts you

Once we check your supporting documents, we contact you by video call to verify your personal details.

The video call takes about 3 minutes. Just before it starts, you receive a notification. The camera turns on automatically to talk to our representative.

Get your login credentials

Once the video call is concluded, you get issued with login credentials for e-Banking and the Eurobank Mobile App.

Choose the Username and the Password you want.

Choose how you wish to bank with us

To complete your application, read and accept the terms and the pre-contractual information document for your account.

Your account and debit card number appear in the terms.

To better serve you with products and services that meet your needs, you also need to answer a few questions about:

- Your financial profile.

- The transactions you wish to carry out through us.

Once you have answered these questions, your application is completed.

Get updated by SMS

Regarding the outcome of your application, you get updated by SMS on the mobile you have registered.

You receive the SMS within 15 minutes to 2 days following your application. Provided we approve it:

If you choose eGov KYC, you only need to upload your ID card. If not, you need to upload files or photos of all supporting documents.

Proof of identity

Take a photo of and upload a document that proves your identity, in which your name appears in English:

- ID card (front and back).

- Valid passport.

If you are serving in law enforcement or the armed forces, upload your uniformed services ID card.

If you log in to eGov KYC, you may only submit your ID card and no other proof of identity.

Proof of income and tax details

If you log in to eGov KYC and we receive all required details, you don’t need to submit any further supporting documents.

Otherwise, choose your professional status, i.e. salaried employee, self-employed, student, etc. and upload the supporting documents verifying your income and capacity.

Then upload a pdf file of:

- Your income tax return statement (latest).

If you are under no obligation to file a tax return, upload a certificate of issued tax number from your local tax office.

In this case, you need to choose the reason you cannot submit an income tax return statement (e.g. you earned no income in the previous year).

Proof of employment

If you log in to eGov KYC and we receive all required details, you don’t need to submit any further supporting documents.

Otherwise, upload a pdf file or a photo of the supporting documents for your profession.

If you are a salaried employee, upload a certificate from your employer, your most recent payslip or a certificate issued by the competent social insurance fund.

If you are serving in law enforcement or the armed forces, upload your uniformed services ID card and your most recent payslip.

If you are a freelance professional, upload any document certifying your profession, such as:

- Sole trader registration.

- Professional ID card.

- Document from the competent professional body.

- Certificate issued by the competent social insurance fund.

- TAXIS registration certificate where your business activities appear.

If you are a farmer, upload your income tax return statement that mentions “Farming” under the “Main Income” section.

If you are a university student, upload your student ID card.

If you are a pensioner, upload your most recent pension slip or a certificate issued by the competent social insurance fund.

If you are unemployed, upload a current unemployment card from the Labour Employment Office (OAED) or a Solemn Declaration under Law 1599/1986 proving you are unemployed.

Proof of home address

To receive your debit card by post, we need to know your home address to send it.

If you log in to eGov KYC and we receive all required details, you don’t need to submit any further supporting documents.

If you upload a certificate of issued tax number or if the address appearing on the income tax return statement is different to your home address, you need to submit another document certifying your address:

- Recent utility bill (it does not have to be in your name).

- Mobile phone bill (issued in the last 6 months)

The Day to Day Account Plus is automatically linked to the Eurobank My Blue Advantage package of Eurobank My Advantage Banking.

The package includes services that make your transactions and day-to-day life easier:

- A payment account for shopping, withdrawals, deposits, money transfers, bills and online payments.

- A Debit Mastercard or Personal Banking Debit Visa with 5-year renewal for individuals. The free debit card renewal applies to the primary account holder.

- €pistrofi loyalty programme – Your debit card card is linked to the only loyalty programme that rewards you in euros instead of points at more than 8,500 partner retailers across Greece.

- Money transfers up to €500 a day from the Eurobank Mobile App through IRIS Payments.

- 1 standing order a month for automatic bill payments, etc.

- Benefits and discounts at partner companies Kotsovolos, Praktiker, Vodafone, SKY express, you.gr, HotelBrain, ELPEDISON, BOX NOW, Globalsat, De’Longhi, Kenwood, Braun and nutribullet.

- Access to services that help you keep track of your cards and finances at other banks, such as Cards Control, Account Aggregation and Payment Initiation.

In addition, the Day to Day Account Plus allows you to easily:

- Build up your tax deductions when you shop or pay online or with your debit card that is linked to the account.

- Monitor its activity on your computer or mobile.

Find out how your day-to-day life gets easier with the Debit Mastercard.

Sent to your address

You receive your debit card by registered mail at the address you indicated on your application.

Along with the card you also receive your card PIN.

Activating your card

You can activate your Debit Mastercard:

- Online with Cards Control through the Eurobank Mobile App or e-Banking – if you already have login credentials.

- Through EuroPhone Banking – Call on +302109555000.

- At our ATMs – if you already have an active Eurobank card.

Go to: More > Card/PIN Activation

€pistrofi loyalty programme

Your debit card is linked to the €pistrofi loyalty programme. You don’t need to sign up.

Use it to earn and redeem cashback rewards at over 8,500 retailers.

People often ask about Digital Customer Onboarding

Which requirements should I meet to open an account through the Eurobank Mobile App?

To open an account through the Eurobank Mobile App, you must:

- Be a natural person.

- Be over 18.

- Be a permanent resident of and be exclusively taxed in Greece.

- Have a Greek-issued proof of identity.

- Have no Eurobank products (active or inactive).

I used to bank with Eurobank but I don’t have an active Eurobank card or valid e-Banking credentials. Can I open an account through the Eurobank Mobile App?

No, you can’t. If you used to bank with Eurobank but currently you don’t have valid e-Banking credentials or an active Eurobank card, you must open a new account at one of our branches.

However, if you have an active Eurobank card and you want to open a new account online from your mobile or your computer, you should first get e-Banking credentials.

It is the basic Eurobank My Advantage Banking package and it is automatically linked to every payment account you open at Eurobank, so you can carry out transactions.

Eurobank My Blue Advantage costs €0.60 a month for each payment account. Payment is made automatically on the first working day of each month for the package services of the previous month.

Inclusion in Eurobank My Blue Advantage is for new clients. Existing clients will be included gradually, after being contacted and informed by Eurobank.